Getting into a car accident is stressful enough. You are most likely facing the pain of injuries, the cost of car repairs, and missed work; the last thing you want to worry about is not getting fair compensation.

Unfortunately, there are some mistakes you can make that can weaken your claim and leave you financially strapped. Car accident attorneys can help you avoid all of these pitfalls and jump the traps that insurance adjusters set for you.

In this article, we’ll explore four common mistakes people make when dealing with insurance adjusters after a car accident and how to avoid them:

1st Mistake: Failing to Document Everything

Sometimes, you might be bombarded by an adrenaline rush after the accident, and you may fail to gather the necessary evidence. Being incapacitated can also prevent you from doing this. Your lawyer can come back to the scene later on and try to salvage what they can, but it’s always best to gather as much evidence as possible while your memory is fresh.

If you’re strong enough, the first thing you should do is whip out your phone’s camera and take pictures of everything. The more visuals you have, the better you can recreate the scene for the insurance company or even in court, if necessary.

If there were any bystanders who saw the accident happen, try to track them down and get their names and contact information. Witness statements can be incredibly valuable in proving fault. They can provide a neutral perspective on what they saw unfold, which can be crucial if the other driver tries to shift the blame away from themselves.

2nd Mistake: Admitting Fault or Discussing the Accident in Detail

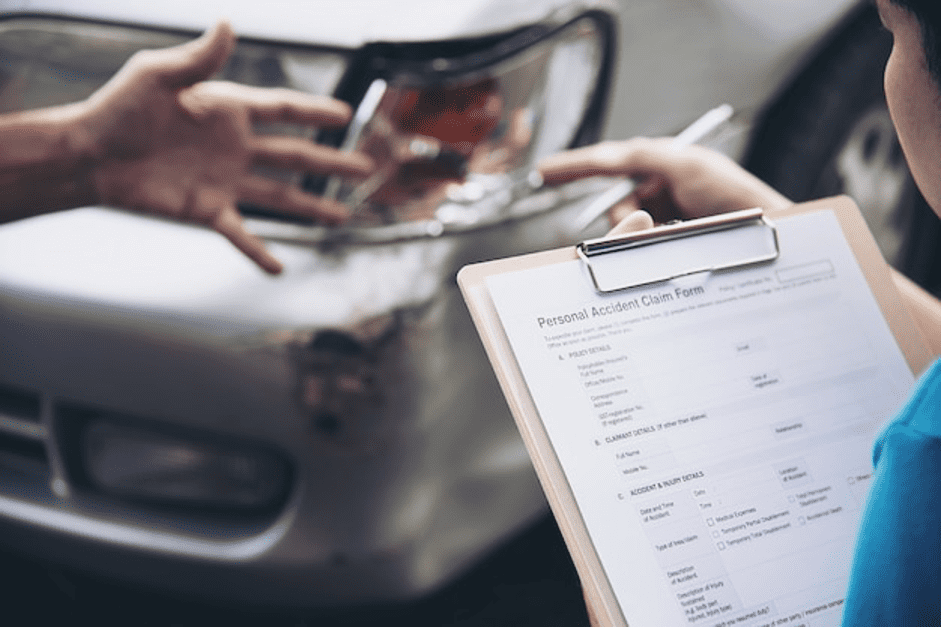

It’s natural to want to explain what happened, but remember, the insurance adjuster is not your friend. Their job is to minimize the insurance company’s payout.

Avoid phrases like “It was my fault” or “I’m sorry.” You might simply be trying to be polite, but the adjusters can completely misconstrue this as an admission of guilt and use it against you later. You should stick to the facts. Simply state the location, date, and time of the accident.

Don’t get drawn into speculating about the cause of the accident or your speed at the time. The adjuster might try to nudge you towards taking some blame. Your story must not change, otherwise, they’ll use it against you.

3rd Mistake: Not Knowing Your Rights and the Value of Your Claim

In an accident, a little knowledge can go a long way. Before you start negotiating with the insurance company, take some time to understand your rights and the different types of damages covered by your car insurance policy in your state.

Go over the policy over and over again. If there’s anything you do not understand, reach out to your attorney. They’ll review it and then explain the complex terms in simple grammar.

4th Mistake: Going it Alone Against the Insurance Company

Car insurance companies employ experienced adjusters who spend their days navigating the world of claims. They have spent many years researching techniques and tactics to railroad you into settling for less.

You need a very competent lawyer who understands the tricks that these adjusters play. A competent lawyer is a skilled negotiator who knows the law and how to work their way around the whole negotiation process. Having a lawyer on your side can significantly improve your chances of getting a fair shake.

Wrapping Up

The adjusters will come to you almost immediately after your accident. Their primary aim is to do everything possible to minimize the amount that the insurance company has to pay.

One of their primary tactics is trying to convince you that you do not need a lawyer. If the insurance company itself have lawyers, why shouldn’t you?

Reach out to a competent lawyer as soon as possible to ensure you do not fall into any of their traps.