Internet translates to convenience and accessibility. While there has been much debate about the pros and cons of an increasingly digital world, the force is in the favour of the internet. The new way of life in the 21st – century is fast, efficient, and digital.

Digitization in India has progressed at a massive scale, especially since the launch of the Digital India initiative. From education to healthcare to agriculture to finance, we’ve sought to connect everything to the internet. The investment landscape, as a result, has witnessed landmark changes in recent decades. The government along with the finance sector has played a principal role in bringing about this tech revolution in the investment industry.

The advent of a digital setup in an essentially outmoded investment industry has led to many positive results, both for the companies and the investors. People believe the process of investment to be far less risky now that they have access to complete information and planning resources. The procedure is easier and more efficient with the aid of the internet.

Capital creation is easily achievable through strategic planning and analytical investment, all possible via digital means. This post details the numerous ways the evolution of internet has worked to simplify investments in India.

#1 – Access to Expansive Information

- The internet is educative. The large-scale presence of information on the web has made it easier for investors to understand the whole process of investment, step by step. There are numerous articles that provide details about the importance of investing while guiding the steps for making a strategic investment plan.

- Several online platforms offer the latest updates regarding investment news and policies. This way, the information revolution on the internet has created many benefits for every investor, from a novice to a professional.

#2 – Communication Growth and Transparency

- The variety of communication resources available through the internet has made investing effortless. You can access almost anything directly on the web and even engage directly with companies instead of relying on brokers.

- This system of online communication has, thus, created a transparent setup for investments. Investors have the complete control over all the decisions and information related to their funds.

#3 – Fast and Reliable Infrastructure

- In addition to increasing the investors’ access to information, the internet has also played a major role in the production of an investment infrastructure that is fast, efficient, and thoroughly reliable.

- With APIs developed for the investment sector, investors are now saved from the hassle of paperwork and documentation. The turnaround time is also lesser. There is error-free and unbiased investment advice.

- As a part of the FinTech revolution, the internet has made investments a great deal less uncomplicated and undemanding.

#4 – Smartphones and E-Wallets

- Mobiles are a treasured possession. The importance of smartphones also lies in the fact that they help you access anything from anywhere. With the help of the internet, investments are also available on your mobiles now.

- Many companies are gradually turning to mobile applications to make their investment services more accessible to the investors. A good example is FinGo by Birla Sun Life Mutual Fund online that gives you systematic planning and investment guidance.

- At the same time, the adoption of e-wallets has enabled the people to invest their money directly from their phones. They can conveniently trade and invest in stocks through mobile apps.

#5 – Advent of Artificial Intelligence and Robo-Advisors

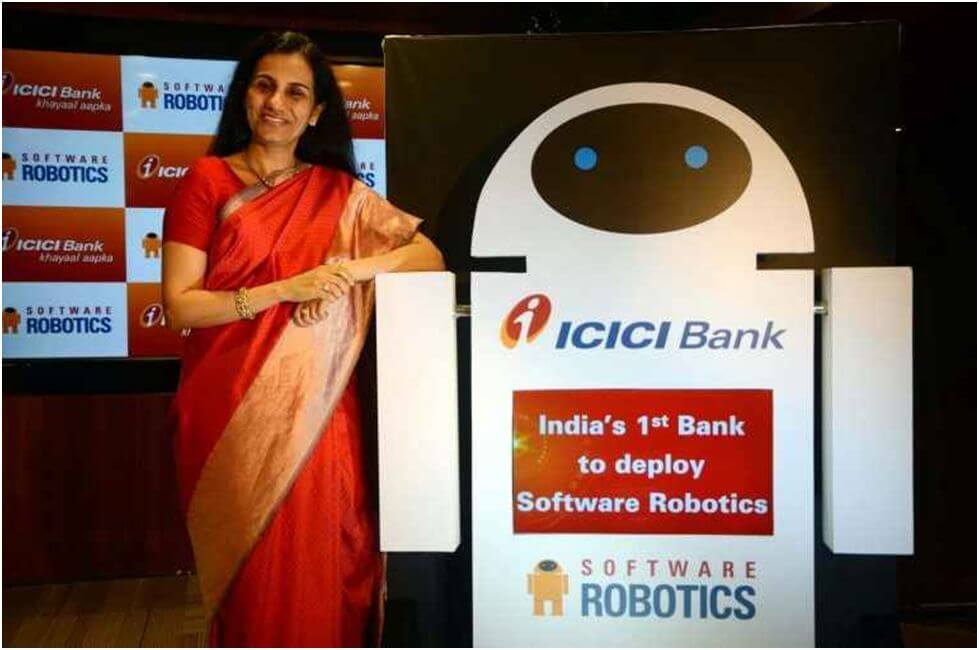

- Artificial Intelligence has proved beneficial in eliminating human intervention from the process of investment. Robo-Advisors have created a whole new revolution in the sphere of investment with their precise analysis and calculated goals.

- This technology helps you with asset allocation and keeps you updated with the fund performances. It is a boon for the decision-making process in investments.

#6 – Reduced the Role of Third Parties

- With the online portals at hand, the investors do not have to resort to a third party to make an investment. There is no need for a personal meeting or call to enter an investment fund. You can simply register at the bank’s online website and put in the required details to get started.

- Even though some investors still prefer to get things done by an experienced professional, the internet has weakened the role of third parties in this regard. In doing so, it has also reduced the overall expenditure on investment. The amounts that you paid to the broker are now safe in your pocket.

The evolution of the internet in India is an ongoing process. But the internet has procured numerous benefits for the investment sector ever since its arrival. By increasing access to information and spreading awareness, it has encouraged investing among people from all walks of life.

There are far less hesitation and fear amid people to invest into different types of funds. On top of this, digitization has made the investment process quicker, more reliable, and transparent. Investments have reached people’s doorsteps with the help of internet.